Medley Management: A 100% Comprehensive advantageous Guide

Introduction to Medley Management

In today’s complex financial landscape, individuals and organizations often seek professional assistance to manage their assets and investments efficiently. One such solution gaining prominence is Medley Management. This article provides an in-depth exploration of Medley Management services, its importance, features, benefits, and challenges.

Understanding Medley Management Services

What is Medley Management?

Medley-Management refers to the practice of overseeing and optimizing various financial assets and investments on behalf of clients.

Importance of Medley Management

Medley-Management plays a crucial role in helping individuals and businesses navigate the intricacies of the financial markets. By leveraging professional expertise and sophisticated strategies, it enables clients to make informed decisions and achieve their financial goals effectively.

Key Features of Medley Management

Portfolio Diversification

One of the primary objectives of Medley Management is to diversify clients’ portfolios across different asset classes and investment opportunities. This diversification helps mitigate risks associated with market volatility and ensures consistent returns over time.

Risk Management

Effective risk management is a cornerstone of Medley-Management services. Experienced professionals employ various risk assessment techniques and implement strategies to protect clients’ investments from potential downturns and uncertainties in the market.

Investment Strategies

Medley Management firms develop tailored investment strategies based on clients’ financial goals, risk tolerance, and time horizon. These strategies encompass asset allocation, security selection, and ongoing portfolio monitoring to optimize returns and minimize losses.

Types of Medley Management Services

Wealth Management

Wealth management services cater to high-net-worth individuals and families, offering comprehensive financial planning, investment management, estate planning, and tax optimization solutions.

Asset Management

Asset management focuses on managing specific assets or investment portfolios for individuals, institutions, or corporations. It involves strategic asset allocation, performance monitoring, and periodic rebalancing to maximize returns.

Investment Advisory

Investment advisory services provide personalized investment advice and recommendations to clients based on their financial objectives and risk profiles. Advisors help clients make informed decisions and navigate market fluctuations effectively.

Benefits of Medley Management

Professional Expertise

By engaging Medley-Management services, clients gain access to a team of experienced professionals with deep expertise in finance, economics, and investment management. This expertise enables them to make well-informed decisions and capitalize on market opportunities.

Time-Saving

Outsourcing investment management to Medley Management firms saves clients valuable time and resources. Instead of researching and monitoring investments themselves, clients can rely on professionals to handle these tasks efficiently, allowing them to focus on other priorities.

Customized Solutions

Medley Management firms offer customized solutions tailored to each client’s unique financial situation, goals, and preferences. Whether it’s retirement planning, wealth preservation, or capital growth, professionals work closely with clients to develop personalized strategies that align with their objectives.

Factors to Consider When Choosing a Medley Management Firm

Reputation and Track Record

When selecting a Medley-Management firm, it’s essential to assess its reputation and track record in the industry. Look for firms with a proven history of delivering consistent results and maintaining high ethical standards.

Fees and Charges

Consider the fee structure of Medley-Management services, including management fees, performance-based fees, and additional charges. Ensure transparency regarding fees and evaluate whether the services provided justify the costs involved.

Client Services and Support

Evaluate the level of client services and support offered by Medley-Management firms. Look for firms that prioritize client communication, responsiveness, and accessibility, providing timely updates and addressing any concerns promptly.

Case Studies: Successful Implementation of Medley Management

Explore real-world examples of how Medley Management services have helped clients achieve their financial objectives and overcome challenges. Case studies demonstrate the effectiveness of professional management in optimizing portfolios and generating sustainable returns.

Challenges in Medley Management

Market Volatility

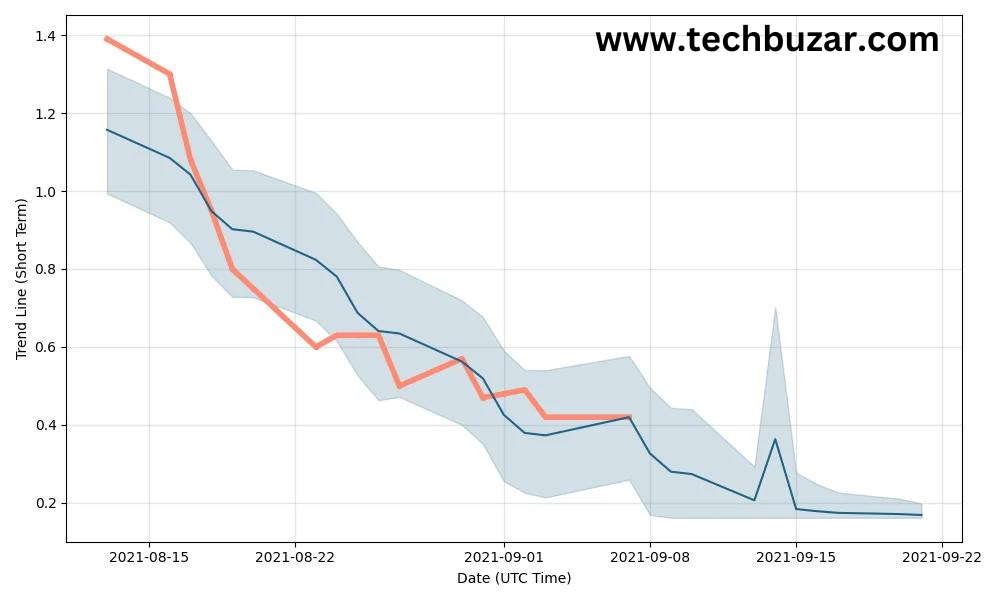

The dynamic nature of financial markets poses challenges for Medley Management firms in managing clients’ portfolios effectively. Volatility, uncertainty, and unexpected market events require adaptive strategies and proactive risk management.

Regulatory Changes

Medley-Management firms must navigate evolving regulatory landscapes and compliance requirements. Changes in financial regulations and industry standards may impact operations, necessitating ongoing monitoring and adaptation to ensure compliance.

Client Expectations

Meeting and exceeding client expectations is an ongoing challenge for Medley-Management firms. Clients may have diverse goals, risk tolerances, and expectations, requiring personalized approaches and effective communication to ensure satisfaction.

Future Trends in Medley Management

As technology and market dynamics continue to evolve, several trends are shaping the future of Medley-Management. These include advancements in data analytics, artificial intelligence, sustainable investing, and the rise of digital platforms offering personalized advisory services.

Conclusion

In conclusion, Medley-Management services play a vital role in helping individuals and organizations navigate the complexities of the financial markets. By leveraging professional expertise, advanced strategies, and personalized solutions, Medley Management firms empower clients to achieve their financial goals with confidence.

FAQs (Frequently Asked Questions)

What is the difference between wealth management and asset management?

- Wealth management typically involves comprehensive financial planning and advisory services, while asset management focuses primarily on managing investment portfolios.

How much does it cost to engage Medley-Management services?

- The cost of Medley-Management services varies depending on factors such as the firm’s fee structure, the complexity of the client’s financial situation, and the level of services required.

How often should I review my investment portfolio with a Medley-Management firm?

- It’s advisable to review your investment portfolio regularly with your Medley-Management firm, typically on a quarterly or annual basis, to assess performance, adjust strategies, and address any changes in your financial situation or goals.

Can Medley-Management firms help with retirement planning?

- Yes, many Medley-Management firms offer retirement planning services, including investment management, income planning, and estate planning, to help clients achieve their retirement goals.

Are Medley-Management services suitable for small investors?

- While Medley-Management services are often associated with high-net-worth individuals and institutions, some